Learn Trends

Register Now

How you transform your business as tech consumer, habits industry

What are Stock Trend?

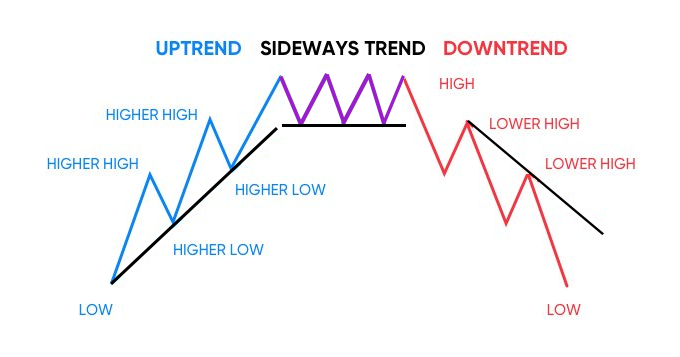

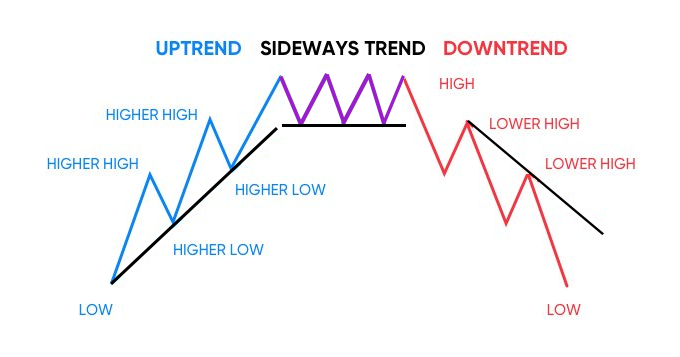

Stock Trends tell us the overall direction of the stock’s prices or the market as a whole. In technical analysis, trends can be analyzed by using trendlines or price action which tells us when the price is making higher highs for an uptrend, or lower lows for a downtrend.

Types of Stock Trend ?

Stock Trends can be divided into:

How to Identify Support and Resistance?

Profit and loss is a very mathematical and R&D process, which you will be going to learn in our courses and that will help you to understand the exact way to visualize the profit and loss formula in the stock market.

Bullish Direction Into Bearish or Sideways

Bearish Direction Into Bullish or Sideways

Using Techincal Indicators For Trend Analysis

Technical indicators are technical tools that help in analyzing the ongoing trend and whether the current trend is going to reverse or not.

Traders can take the help of the Relative Strength Index (RSI) indicator that can be used in trend analysis strategies.

Traders can buy the stock it is trending up or down with strong momentum and sell it when the stock loses momentum.

Tools For Identification

How to Identify Trend with Gujarati Garba?

We can teach stock market trend using Dandiya

How to get reverse Trend on right Time Frame?

TECHNICS

STOPLOSS TECHNICS

A stop loss is intended to restrict a financial backer’s loss on a security position.

QUANTITY TECHNICS

Quantitative trading comprises exchanging procedures in view of quantitative examination, which depends on numerical calculations and calculating to recognize open trading doors.